It is clearly a sign of changing times: Silvio Berlusconi, the longest-serving prime minister of the Italian Republic, wants to fight, at the ripe age of 82, in the European parliamentary elections next May. He pledges to make sure that “Europeans don’t stray too far from Western values” and fall under “the domination of the Chinese empire whose convictions and values are opposed to our own.”

China, of course, has nothing to do with Berlusconi’s real intentions; it’s just a device to attract attention like a bandana he was sporting, after a hair transplant operation, at his spectacularly beautiful Villa Certosa in Sardinia, when he was hosting the then-British Prime Minister Tony Blair in the spring of 2004.

Berlusconi sees that the Italian governing coalition party M5S, with its polls down to 25.4 percent, is losing ground. He, therefore, wants to boost the chances of his right-of-center Forza Italia to take its place alongside his increasingly popular allies of the Northern League, currently polling at 36 percent.

The Chinese have nothing to fear because here is what the other Italy — the one that works — is doing: Last Monday, Italy’s low-cost airline Neos Air launched its weekly service from Milan to Guiyang in China’s Guizhou Province to serve the rising flows of tourism and other economic exchanges.

In This Content

Trump can see that Germans, too, were taken for a ride

To my knowledge, Italians have never complained about trade. They always find ways to get in. At the time when the U.S. was raising hell about trade with Japan in late 1980s/early 1990s, fashionable boutiques, restaurants and food shops around Tokyo’s Ginza and Omotesando were full of Italian merchandise.

Germany and France are very different stories.

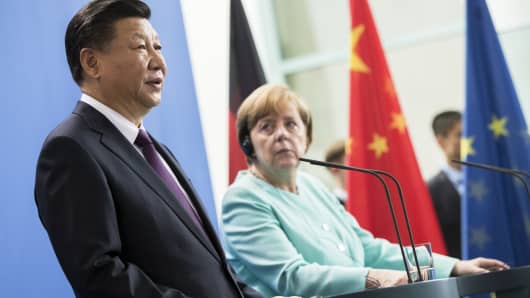

In its dealings with Germany, China has always shrewdly sought to sell its market access in exchange for German technology and managerial know-how. A beaming Chinese Premier Li Keqiang proclaimed during his visit to Germany in May 2013 that the two countries were a “dream team.” To circumvent the European Commission’s trade barriers, Li offered special entries to German manufacturers because Beijing wanted to move from smokestacks to Germany’s ultra-modern, IT-driven production processes.

China got that, partly because Germany was looking for business alternatives to recession-ridden European markets.

With Germany’s 77.6 billion euros worth of exports to China in the first 10 months of this year, China is now Germany’s third-largest export market, after the U.S. and France. Sales to China are slowing, though, and Asia’s largest economy is still one of rare markets where Germans continue to run a relatively small negative balance on goods trade.

For years, German companies in China have been complaining about an increasingly difficult business environment, while the Chinese apparently enjoyed open access to German and other EU markets, and went on a buying spree of hi-tech companies, including a 4.5 billion-euro takeover in 2016 of Kuka, a manufacturer of industrial robots.

Since then, Berlin has restricted Chinese investments in its industries, and German firms have become increasingly concerned that their earlier technology transfers are being used to edge German products out of Chinese and third-country markets.

Last week, the Federation of German Industry issued an alarming report that China was using “price dumping, takeovers of European hi-tech industries and government interventions,” summoning Berlin and the EU to fight those trade practices head-on.

Brits no longer want ‘golden relationship’

Partly as a result of such trade and investment problems, Germans are now shifting attention toward service trades with China. The second German-Chinese financial dialogue in Beijing last Friday held out hopes that the two countries would be able to expand their bilateral banking and insurance transactions.

With France, politics have moved center stage in Sino-French relations.

Hoping to expand its arms sales to India, Paris has signed up as Delhi’s strategic partner to contain China’s presence and operations in the Indian Ocean. Subsequently, that partnership has included the U.S. and Australia as key players in the Indo-Pacific region.

Beijing, clearly, looks at that with disappointment in the context of what should be a close and confident Sino-Indian relationship in BRICS and the Shanghai Cooperation Organization. To add more spice to that rivalry, the Pentagon said last week, during its missile defense review, that “India is (America’s) leading military partner and a key element in our Indo-Pacific strategy.”

France, therefore, has signaled that it irrevocably moved to the camp hostile to China’s broadening global influence.

The U.K. also seems to have traded its “golden relationship” with Beijing for an American-led economic and military challenge to China.

While declaring its commitment to the “golden era” of Sino-British relations, London is accused by China of meddling in what Beijing considers its territorial waters in the South China Sea. A few months ago, China says, the U.K. ran its warship HMS Albion in the waters of the (China claimed) Paracel Islands, and, last week Britain completed with the U.S. a six-day military drill “in Asian waters.”

Beijing is asking: What exactly is the United Kingdom’s China policy?

Investment thoughts

The European Union’s dilly-dallying on trade and investment issues with China is incomprehensible.

In my view, Germany is again the main culprit because nobody can oppose German negotiating instructions to the EU’s trade commissioner. Ironically, the German business community in China (more than 5,000 companies, according to Chinese data) has been most vocal in fielding its trade and investment complaints with Berlin and Brussels — to no avail.

Last week, the German Finance Minister Olaf Scholz made what looked like a glad-handing trip to Beijing by changing the subject from goods trade to the pie-in-the-sky of financial services.

Those who have had enough of a German lock on EU policies are watching and steadily gaining ground in opinion polls in Italy, France, Hungary, Romania, Poland, etc. In four months from now, they are likely to sweep the European parliamentary elections, creating, they hope, a point of departure to a new Europe.

Berlusconi also has old scores to settle with Germany. That, not one more election victory, is what is driving him.

Meanwhile, China should not worry. Its freight trains reportedly made last year a record 6,363 trips to Europe, a 73 percent increase from 2017, unloading Chinese garments, auto parts and chemicals. Beijing can continue to sell its stuff, calmly watch the EU unravel and rearrange its deck of European cards when the time comes.

[“source-cnbc”]