Indiabulls Housing Finance Shares Crack 38% on Doubts Over Merger with Lakshmi Vilas Bank

Indiabulls Housing Finance Ltd shares cracked over 38% on Monday on the apprehensions that the proposed merger with Lakshmi Vilas Bank Ltd could face a […]

Indiabulls Housing Finance Ltd shares cracked over 38% on Monday on the apprehensions that the proposed merger with Lakshmi Vilas Bank Ltd could face a […]

Pramod Sawant PANAJI: Goa chief minister Pramod Sawant retained home, finance and all other portfolios held by his predecessor Manohar Parrikar. Sawant on Friday allotted departments […]

In 2008, nobody was really talking about Big Data – but the financial crash led to more stringent regulatory requirements for banks to manage the […]

New Delhi: The 15th Finance Commission, in its interim report for 2020-21, has marginally reduced the share of states in the divisible pool of central […]

UAE’s Abu Dhabi Commercial Bank (ADCB) has digitised trade finance for its customers using the Singapore-based dltledgers Blockchain platform. ADCB reported completion of its first […]

Motilal Oswal has given a buy rating to Cholamandalam Investment & Finance with a target price of Rs 225. Disbursements declined 36 per cent year […]

Bankers and investors fear China’s push to impose national security laws on Hong Kong threaten the city’s future as an international financial centre. If it […]

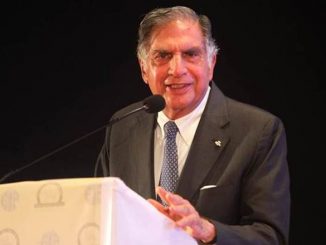

Ratan Tata and Nandan Nilekani invested Rs 50 crore each into Avanti Finance two years ago. Avanti Finance, the microloan-focused NBFC promoted by Ratan Tata and Nandan […]

ICAI Diploma On Management And Business Finance Exam Schedule 2022: The Institute of Chartered Accountants of India, ICAI has released the examination schedule for Diploma on […]

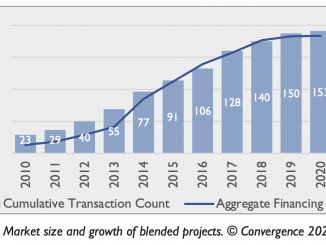

Project finance is the financing approach typically applied to the long-term construction and development of natural resource and physical infrastructure assets. Equity and debt funding […]

Copyright © 2025 | WordPress Theme by MH Themes