Confidential area needs to move forward framework speculation: DFS secretary

While the public authority is hard work the ongoing framework spending, the confidential area needs to move forward as the nation is taking a gander […]

While the public authority is hard work the ongoing framework spending, the confidential area needs to move forward as the nation is taking a gander […]

Finance Priest Nirmala Sitharaman, with an end goal to upgrade the engaging quality of the New Duty System for salaried citizens, presented two massive changes […]

In the context of globalization and active business abroad, choosing an effective and profitable method of international money transfer becomes a strategic step for entrepreneurs […]

Recently my friend Jennifer Wright at TheGloss.com came across another study purporting to show that men prefer to date women who are less intelligent than […]

Indiabulls Housing Finance Ltd shares cracked over 38% on Monday on the apprehensions that the proposed merger with Lakshmi Vilas Bank Ltd could face a […]

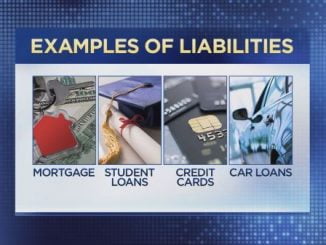

What’s your net worth? Even if you don’t fly on private jets or play polo, this simple equation is an important tool that says a […]

Saving for the future and growing your assets is a wise decision. it can also be incredibly confusing for the average person. Whether you are […]

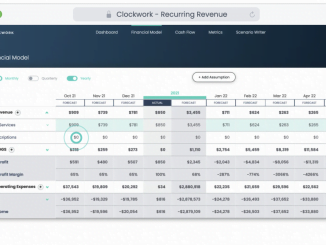

Recurring revenue seems pretty simple on the surface, but just because recurring revenue is “predictable,” that doesn’t mean forecasting recurring revenue is easy. Month-over-month growth […]

Are you a “hang on to every last drop of summer” kinda person? Or are you more of the “pumpkin spice latte in August” variety? […]

For the first time in five years, tech investors aren’t the life of the Wall Street party. As 2021 winds down, the tech-heavy Nasdaq Composite is up […]

Copyright © 2025 | WordPress Theme by MH Themes