Recurring revenue seems pretty simple on the surface, but just because recurring revenue is “predictable,” that doesn’t mean forecasting recurring revenue is easy. Month-over-month growth assumptions can paint a general picture of MRR for investors, but if you really want accurate projections – the type that’ll help you navigate strategic decisions and optimize your finances – you’ll ultimately need a more detailed forecast.

The bad news is that financial modeling can send you down a spreadsheet rabbit hole pretty quickly, and it’s a nightmare to regularly update that data and check on formulas, which means a lot of founders unfortunately don’t leverage their forecasts often as they should.

The good news is that there’s a MUCH easier way to do it!

In This Content

Step 1 – Build Your Model in a Minute

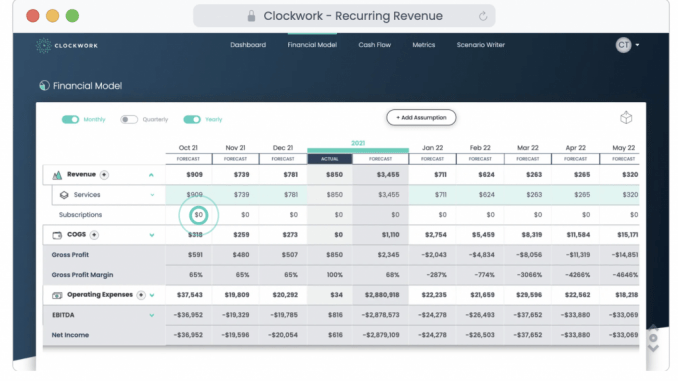

Typically, you’d need to pull historical performance data, drop it all into a spreadsheet, link various sheets, hack together some formulas, carefully eliminate the #REF’s, and tinker with formatting until everything looks right. We always hated that, so we built Clockwork.

If you use QuickBooks Online or Xero as your accounting system, you can connect to Clockwork with a click and get all of your data synced up in about a minute. As soon as you’re connected, you’ll get performance dashboards, a custom 5-year financial model that learns the behavior in each account, a 52-week cash flow forecast that accurately models the way you collect and spend, plus powerful tools to explore “what if” scenarios and best/worst case assumptions, all with your own real-time data.

Step 2 – Dial In Your Assumptions

The hardest part about recurring revenue assumptions isn’t how you build them, but rather figuring out what to build. In other words, what inputs will drive your forecast and how are they related? This will all depend on the specific drivers in your business, the behavior of your recurring revenue, and how new business is generated.

Step 3 – Stay in the Loop

Now that you have a completely dialed-in financial model (which should’ve only taken ~15 minutes), what do you do with it? That could be its own textbook, so we’ll just say that in general, you need to make sure you regularly refer back to your financial model to see how you’re performing vs. plan, and to update your forecasting assumptions when things change. You can learn a lot about your business just by observing what’s going on and regularly challenging your assumptions (or testing new ones altogether). On the flip side, there’s no telling what you’re missing if you let your models sit untouched for too long. Since Clockwork updates automatically every hour, you can literally login anytime you want to get a real-time pulse, without any of the headaches of updating spreadsheets…so if you want to check up on your finances every day, go for it!

[“source=eehealth.org”]