In just a few years, mobile payment has become so ingrained in the lives of Chinese people that they are driving stores in overseas tourist destinations to adopt the technology.

Three-fourths of supermarkets and convenience stores in Singapore, Malaysia and Thailand now accept Chinese mobile payment, according to a Nielsen survey released Monday. Some 71 percent of duty-free stores and luxury stores in those countries also take the payment method.

The two dominant operators are Alipay, which is run by Alibaba-affiliate Ant Financial, and WeChat Pay, which is tied to Tencent’s ubiquitous Chinese messaging app, WeChat. Alipay co-issued the report, which covers 1,244 merchants and 2,806 Chinese residents surveyed in the fall of 2018.

“Along with the increasingly personalized and sophisticated demand of Chinese tourists, improving the global coverage of mobile payments is a long-term project (for merchants),” Andy Zhao, president of Nielsen China, said in a statement.

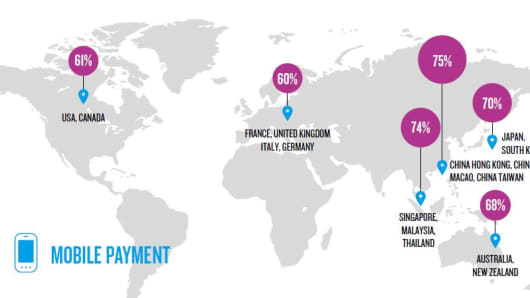

Usage rate of mobile payment by Chinese tourists

Source: Nielsen

Thailand is expected to be the most popular overseas travel destination for Chinese tourists during the Chinese New Year holiday in February, according to travel booking site Ctrip. Japan, Malaysia, Singapore and the U.S. also rank among the top 10 countries for what Ctrip predicts will be 7 million Chinese tourists during the upcoming holiday.

From street peddlers to high-end department stores, mobile pay has taken China by storm. Company promotions, a lack of credit card usage and extensive smartphone penetration helped turn a cash-based society into one in which seemingly everyone scans a QR code with a phone to pay, regardless of age. Transaction volume skyrocketed from around $5 trillion in 2016 to nearly $16 trillion by the first quarter of 2018, according to Analysys data cited in a Hillhouse Capital report.

As Chinese tourists take the mobile pay habit abroad, merchants are adapting quickly. Of those in Singapore, Malaysia and Thailand who accept Chinese mobile pay, 88 percent adopted the technology in the last two years, the Nielsen survey found. Of those who accept the payment methods, 40 percent said overall foot traffic increased.

The report also said roughly 60 percent or more of Chinese people surveyed said they used mobile pay during trips last year to the U.S., Canada, the U.K., France, Germany or Italy.

Overall, more Chinese tourists used mobile pay than cash while traveling last year, the report said. Bank cards did remain the most common payment method, while shopping, accommodation and dining remained the top three spending categories.

To be clear, increased overseas support for te technology doesn’t necessarily mean locals will be using it anytime soon. Alipay, for example, requires a Chinese mobile number and bank account. The payment technology works abroad through partnerships with local merchants and companies, such as First Data in North America.However, just as luxury stores hired Mandarin-speaking staff to serve Chinese tourists, more tourist destinations may feel the need to accept Alipay and WeChat Pay.

““Looking forward, we will support the efforts of more local merchants to connect with Chinese tourists and boost their business growth,” Chen Jiayi, head of business operations for Alipay’s cross-border business, said in a statement.

Even as China’s economy slows, Ctrip’s expectation of 7 million outbound travelers this Chinese New Year is up slightly from last year’s prediction of 6.5 million.

In addition, data shows more people from smaller cities are interested in traveling overseas. The country’s cities are divided into tiers, with Beijing and Shanghai among the first tier and Nanjing and Chengdu among the second.

The Nielsen survey found more tourists from second-tier cities than first-tier ones visited Europe last year and spent an average of $6,006 on outbound travel, up from $472 in 2017.

[“source-cnbc”]